2021 had been a prosperous year for container carriers despite the supply chain and logistics issues that were prevalent due to the pandemic. Now in 2022, this positive outlook has carried over. The continued perfect storm of high demand, maxed out capacity, port congestion, changing consumer habits, and general supply chain disruption are factors for the record-high level of rates.

However, in the face of those same factors where companies around the globe have been looking into strategies and methods to improve their capacities and deliverables, sustainable supply chains are now the key. It was previously predicted by a few CEOs that supply chains in particular will integrate technology and other creative aspects with their systems to increase manufacturing and shipping capacity, and its resilience. With the additional conflict between Ukraine and Russia, supply chains are due to experience more troubles than before.

China, The Rising Powerhouse Joins the Market

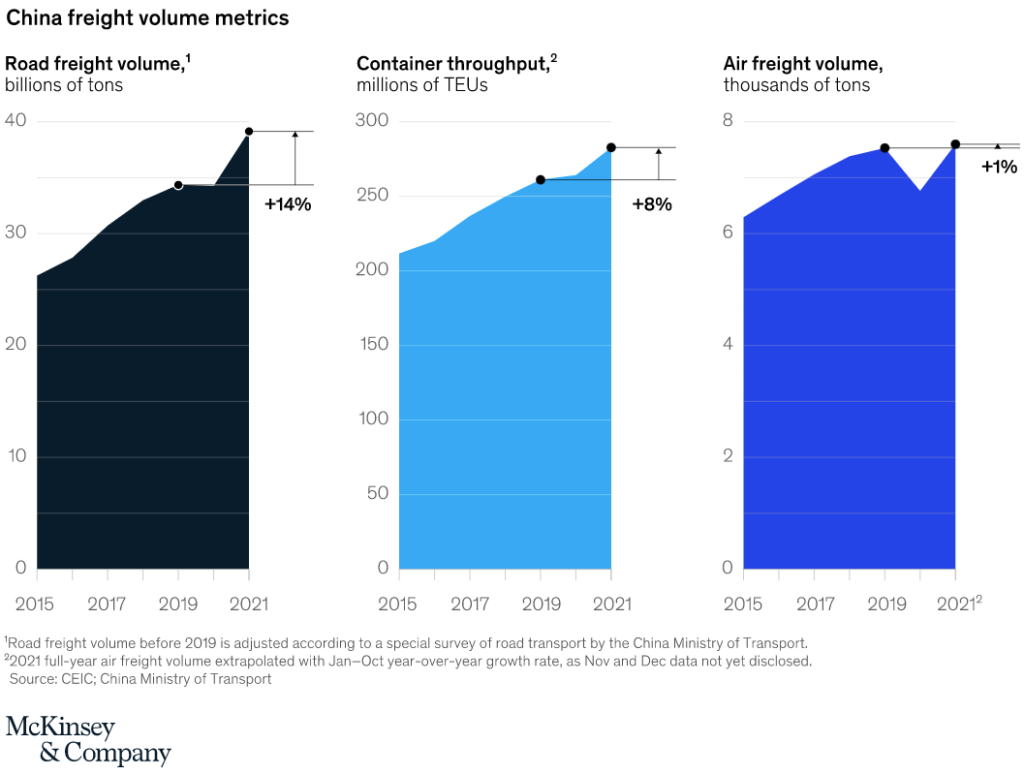

According to this McKinsey report, the pandemic has ushered the Chinese logistics into an interesting stage of its evolution and five trends can be observed. One such trend is that despite the dampening effect on freight volumes in China, all delivery modes rebounded and surpassed pre-pandemic levels by 2021.

Presently, it is reported that China will strengthen its cross-border logistics business and intermodal transportation services, indicating that the rising powerhouse will compete with the existing global logistics players. The new logistics group will provide a wide range of logistics services, including warehousing, distribution, packaging, intermodal transportation, and cross-border e-commerce.

The State Asset Supervision and Administration Commission (SASAC) and state investment company China Chengtong each own 38.9%. Strategic investors include China Eastern Airlines, COSCO Shipping, and China Merchants Group, which will respectively hold shares of 10%, 7.3%, and 4.9%.

It currently owns 120 specialized railway lines, with routes connecting Asia and Europe, and it also has 42 warehouses and other storage facilities covering 4.95-million square meters as well as a transportation network that currently covers 30 Chinese provinces and has a presence in five continents, according to CCTV.

Forwarding companies increase their transport capabilities.

In 2021, French logistics provider GEODIS chartered its first vessel to alleviate container capacity shortage on its Asia-Europe routes.

The company has launched its own-leased A330-300 full freighter aircraft under its brand name to upgrade its AirDirect services between Europe, the United States and Asia.

This strategic move has proven to be a dependable, efficient solution because it allowed for a more sustainable supply of air cargo space, resulting in the travelling route to become a cornerstone in our global the company’s freight services network. Since the start of its freight services between Frankfurt and Chicago in 2020, it has grown with more than 85% of its U.S.

Air cargo growth continues to be driven by strong demand.

Current Global Issues

The conflict in Ukraine is expected to have a domino effect on various supply chains as global companies close factories during the Russian invasion, halting the production and shipment of goods and components. The conflict in Ukraine is expected to have a domino effect on various supply chains as global companies close factories during the Russian invasion, halting the production and shipment of goods and components. The supply chains for the following markets are fracturing as a result of the conflict.

Ukraine and Russia together account for nearly a third of the world’s wheat market, 19% of the world corn supply, and 80% of exported sunflower oil, per Insider. Russia is also the third-largest supplier of nickel for lithium-ion batteries. The two countries also lead the global production of copper and platinum.